Medicare’s Quiet Shift: Private Plans Now Cover Majority

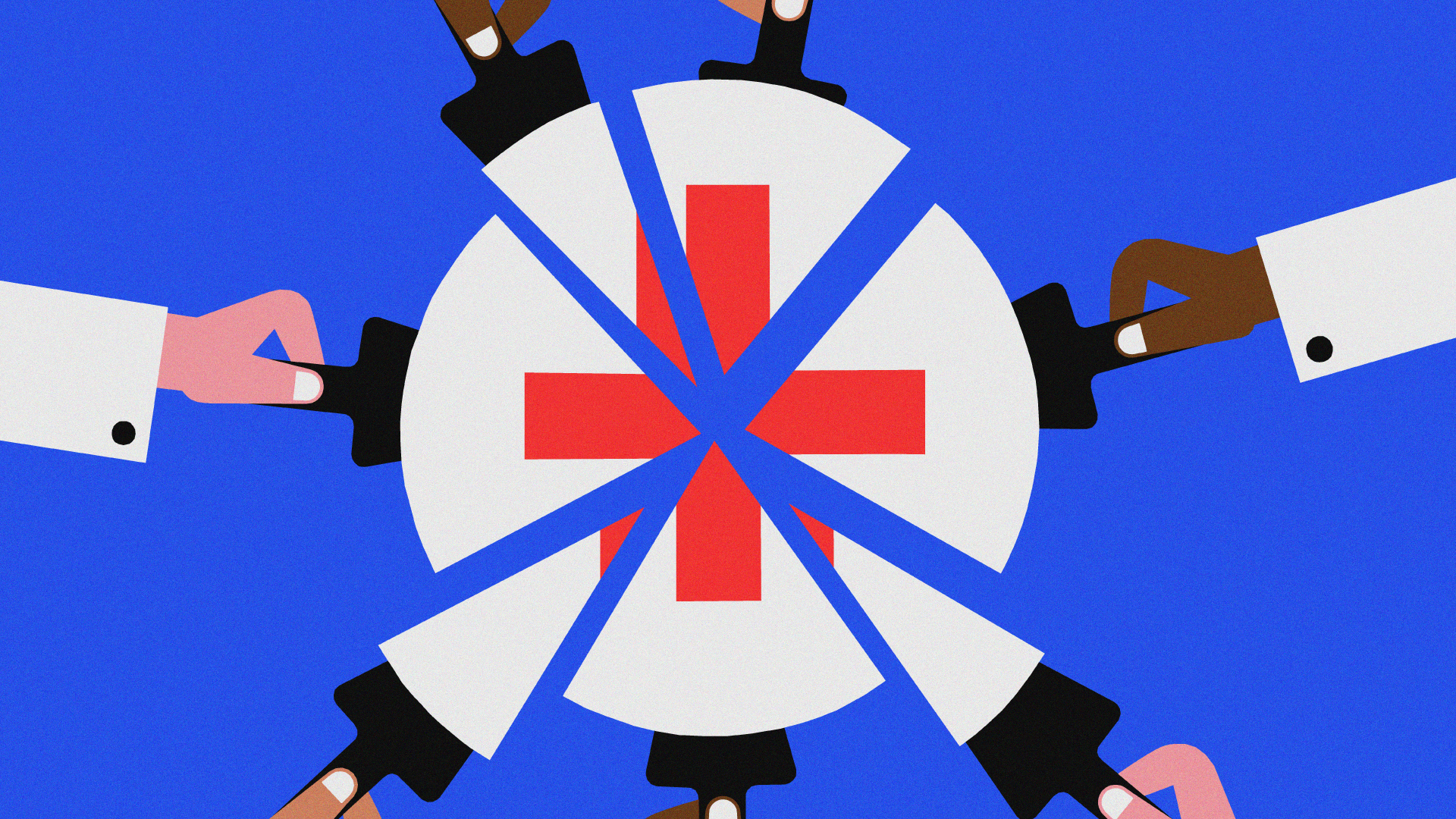

For millions of Americans navigating Medicare’s open enrollment, the landscape of healthcare is subtly, yet profoundly, changing. A significant trend is reshaping the program: the rise of Medicare Advantage plans, administered by private companies, which now cover more than half of all Medicare beneficiaries. This shift represents a fundamental transformation of Medicare, moving it from a traditional government-run program to a public benefit increasingly managed by private entities, raising crucial questions about cost, access, and quality of care.

The Rise of Medicare Advantage

Medicare Advantage (MA) plans have witnessed explosive growth over the past decade. Currently, these plans cover approximately 34 million Americans, representing more than half of Medicare’s 63 million enrollees. This figure is nearly double what it was just ten years ago, signaling a clear preference for these private alternatives, or at least, a strong push towards them. While proponents argue that MA plans offer enhanced benefits and coordinated care, critics express concerns about their potential impact on traditional Medicare and the overall healthcare system.

Cost and Access: A Balancing Act

The increasing popularity of MA plans has reignited the debate surrounding Medicare’s long-term solvency. Concerns have been raised about the true cost of these plans to the federal government. Recent data suggests that Medicare Advantage enrollees may have access to significantly fewer doctors and healthcare providers compared to those enrolled in traditional Medicare. This raises questions about whether the promise of comprehensive care under MA plans is being fully realized, particularly in rural areas or for patients with complex medical needs. The focus on managed care within these private plans can also limit patient choice and require prior authorizations for certain treatments, potentially delaying or denying necessary care.

Implications for Patients and Taxpayers

The shift towards private Medicare plans has far-reaching implications for both patients and taxpayers. For patients, the choice between traditional Medicare and Medicare Advantage involves weighing factors like provider networks, out-of-pocket costs, and the level of flexibility in seeking care. For taxpayers, the financial sustainability of Medicare hinges on the efficiency and effectiveness of these private plans. Ongoing scrutiny of MA plans is essential to ensure they are delivering value for money and not contributing to unnecessary healthcare spending. Further, it’s important to consider whether the incentive structures within these plans are truly aligned with the best interests of patients, or if they prioritize profits over patient care.

The increasing prevalence of Medicare Advantage plans marks a pivotal moment in the evolution of American healthcare. As more beneficiaries opt for private alternatives, it is vital to carefully monitor the impact on access to care, the financial stability of Medicare, and the overall quality of healthcare services provided to seniors. A transparent and data-driven approach is crucial to ensure that Medicare continues to serve as a reliable safety net for all Americans.

Based on materials: Vox